Year End Accounts and Corporation tax

Year End Accounts and Corporation tax

From £70 per month

Limited Companies are required to file company accounts with HMRC and Companies House to provide a comprehensive overview of the company’s financial performance and comply with tax laws, regulations and reporting requirements.

There are annual deadlines that carry penalties if they are not met, we can ensure all your filing requirements are met accurately and timely.

We provide an easy to understand breakdown of what the year end accounts actually mean and will understandingly welcome all queries and questions.

Year End accounts must be carefully and accurately prepared for submission to Companies House and HMRC.

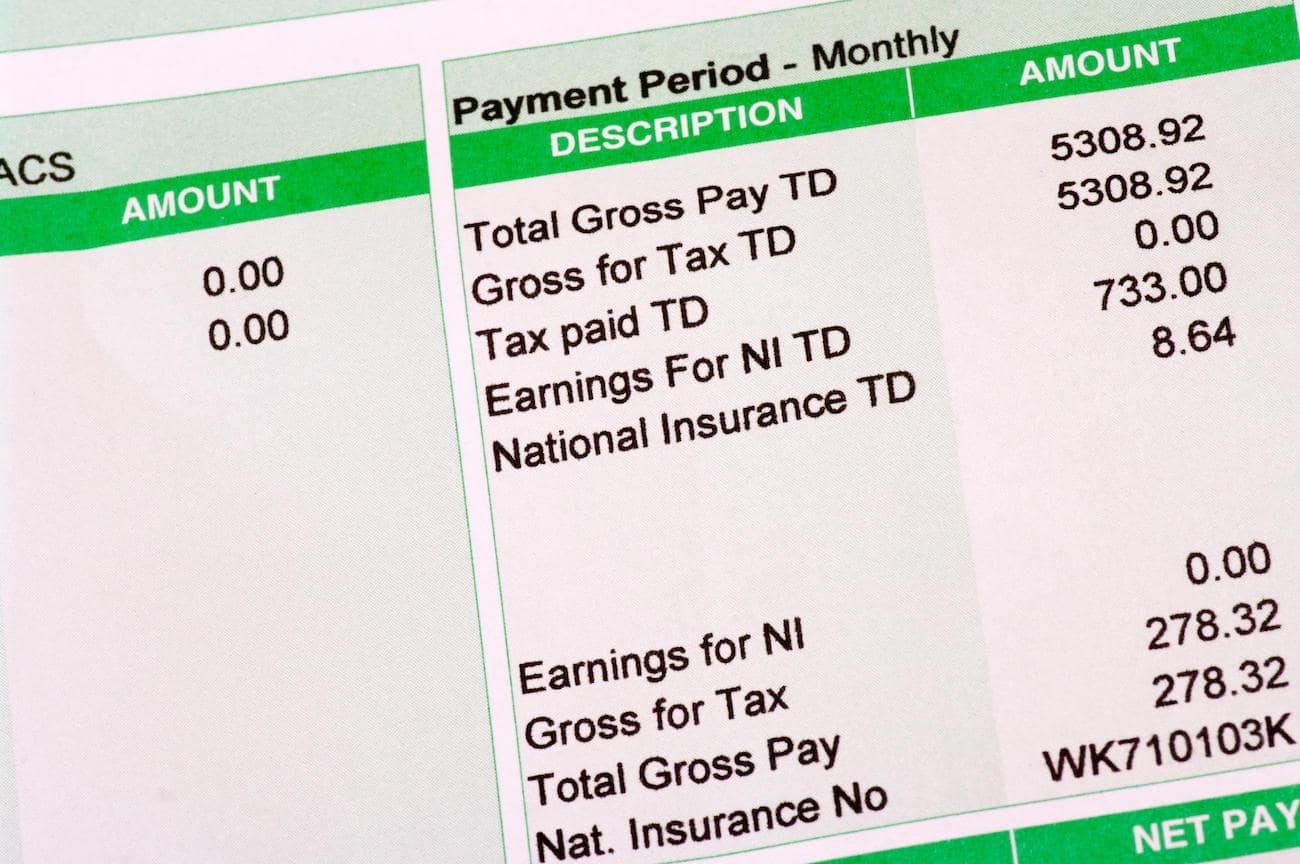

Fixed Assets, Depreciation, Current Assets, Short and Long Term Liabilities and Bad Debts must all be recorded in the accounts correctly, ensuring they fall into the financial periods they relate to, as well as the accounts meeting statutory requirements and complying with the Financial Reporting Standards. Most of our clients fall within the Financial Reporting Standards FRS 105 and 102a respectively.

It is a Director’s responsibility to meet reporting requirements but without accounting knowledge, it can all become quite daunting. Leisa at LB Accounts will prepare your accounts and put all the complexities into a simple and easy to understand format so you can understand your business finances and you are aware of what the financial statements mean before you sign them for submission.

Get in touch to how LB Accounts can help. By understanding the core principles for setting up your business and your long term goals, we can help you reach that destination.