YOUR MISSION IS OUR PASSION

Leisa Brett MAAT is passionate about supporting her clients with their business and personal financial goals. A helpful accountant, knowledgeable of financial regulations, tax laws, and providing assistance with tax and dividend planning. Leisa goes above and beyond to assist clients and their companies.

Leisa is very approachable and willing to explain complex financial concepts in simple terms, addressing concerns or questions with patience and support.

Proactively offering advice on how to save money and optimize financial strategies. Not just confined to crunching numbers but helpful and building trusting relationships through consistent communication, reliability, and a commitment to the financial health of her clients.

All services are provided for a fixed monthly fee. No unexpected bills.

Leisa Brett MAAT is passionate about supporting her clients with their business and personal financial goals. A helpful accountant, knowledgeable of financial regulations, tax laws, and bookkeeping but also goes above and beyond to assist clients and their companies.

YOUR BUSINESS GOALS

Leisa wants to know your business goals as well as your personal goals – what’s the idea behind your business? – what are your future aspirations? What do you want your business to achieve, to enable you to reach your personal financial goals?

By understanding the core principles for setting up your business and your long term goals, we can help you reach that destination.

About Us

Leisa is a qualified and experienced accountant, regulated by the AAT.

Working in the accountancy industry since 2014, in a large firm of accountants focussing on personal and business tax, as well as in house with various sized businesses with turnovers of £50,000 to £8,000,000, managing the running of finance departments and supporting directors with monitoring profits, setting financial plans, providing advice on tax and dividend planning and forecasting cash flows.

Leisa takes pride in helping tax-payers and business owners understand the complexities of tax and accounting in simple and easy to understand ways to assist them with making the right financial decisions.

Leisa is a qualified and experienced accountant, regulated by the AAT.

Working in the accountancy industry since 2014, in a large firm of accountants focussing on personal and business tax, as well as in house with various sized businesses with turnover of £50,000 to £8,000,000, managing the running of finance departments and supporting directors with monitoring profits, setting financial plans, providing advice on tax and dividend planning and forecasting cash flow.

Limited Companies, VAT and Corporation Tax

We can provide everything you need to successfully run the finances of your company from bookkeeping to year end accounts and corporation tax.

We provide bookkeeping services and software, ensuring all allowable expenses are being accounted for, monitoring income approaching the VAT registration threshold, registering for VAT when required, submitting VAT returns, providing accurate and informative monthly profit and loss reports and preparing and filing of Year End Accounts and Corporation Tax Returns.

We provide our services in a vast number of different industries namely E-Commerce, Hospitality, Construction, Manufacturing, Retail, Art Galleries, Tech Services, Removal Companies, Mergers and Acquisitions, Animal Care, Security Services, Hairdressers and Beauty Salons and Property Owners and more.

We can provide everything you need to successfully run the finances of your company from bookkeeping to year end accounts and corporation tax.

We provide bookkeeping services and software, ensuring all allowable expenses are being accounted for, monitoring income approaching the VAT registration threshold, registering for VAT when required, submitting VAT returns, Year End Accounts and Corporation Tax Returns.

Self Assessment Tax Returns / Sole Traders and Partnerships

We advise on allowable business expenses, ensure you are claiming all expenses on your tax return and record income and expenses accurately and timely.

We offer advice and support year round relating to your personal tax situation, helping you to plan ahead for a future tax bill.

We can help you manage a mix of employed and self employed income, property let income, advising on tax bands, national insurance contributions and how pension contributions affect your taxable income. Ensuring you are obtaining available tax relief.

We advise on allowable business expenses, ensure you are claiming all expenses on your tax return and record income and expenses accurately and timely.

We offer advice and support year round relating to your personal tax situation, helping you to plan ahead for a future tax bill.

CIS (Construction Industry Tax)

Construction Industry Tax (or CIS) is a tax that you must register for if you trade within the construction industry as a plumber, electrician, scaffolder, builder, carpenter plus many other trades whether operating as a Sole Trader or a Limited Company.

Subcontractor or a Contractor, we can ensure you are registered and meeting HMRCs requirements with tax deductions, filing requirements and complying with legislation.

We can advise on different tax deduction rates and apply for 0% tax deductions if you meet qualifying criteria.

Construction Industry Tax (or CIS) is a tax that you must register for if you trade within the construction industry as a plumber, electrician, scaffolder, builder, carpenter plus many other trades whether operating as a Sole Trader or a Limited Company.

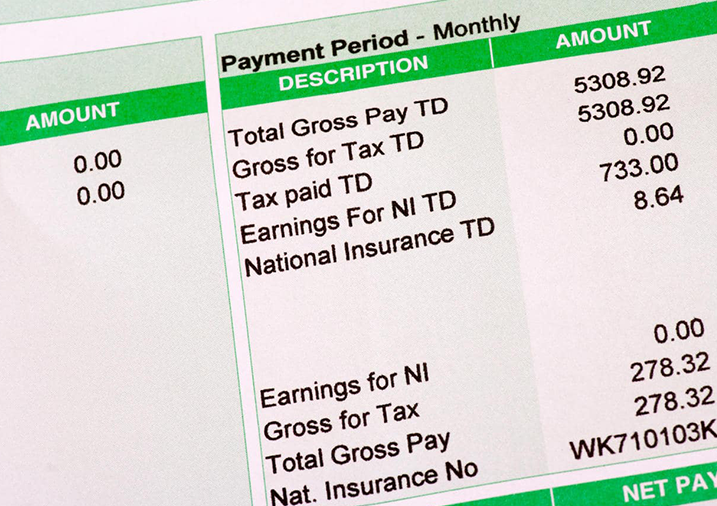

Payroll

Whether you have 1 or 100 employees, we can process the payroll, provide payslips, advise what to pay and when to HMRC, discuss and apply pension contributions for auto enrolment, account for holiday pay, sick pay, maternity/paternity pay and all payroll requirements.

HMRC issue penalties for non filling of PAYE if registered and the penalties can build up monthly therefore it is important to keep on top of filing and payment deadlines.

P11D

Benefits provided to employees such as a company car, a mobile phone, meal vouchers and private medical insurance can be liable for personal tax and company national insurance contributions. It is important these benefits are reported accurately and on time to HMRC. We can keep you within the filing deadlines and ensure accuracy of your returns.

Whether you have 1 or 100 employees, we can process the payroll, provide payslips, advise what to pay and when to HMRC, discuss and apply pension contributions for auto enrolment, account for holiday pay, sick pay, maternity/paternity pay and all payroll requirements.

P11D

Benefits provided to employees such as a company car, a mobile phone, meal vouchers and private medical insurance can be liable for personal tax and company national insurance contributions. It is important these benefits are reported accurately and on time to HMRC. We can keep you within the filing deadlines and ensure accuracy of your returns.

Example Pricing Packages

This an example of some of our packages, every business has different requirements and a different level of transactions, monitoring and processing but these packages demonstrate our most popular pricing structures.

Package 1

Sole Trader

(Not a Limited Company)

£50 per month

Services Include:

Xero Accounting Software

Xero Software Training

Sole Trader Accounts

Self Assessment Tax Return and submission to HMRC

Assistance throughout the year with queries

Assistance with any HMRC correspondence

Package 2

Small Limited Company

£110 - £250 per month

Services Include:

Xero Accounting Software

Quarterly VAT Returns

Monthly Director’s Payroll

Year End Accounts

Corporation Tax Return

Confirmation Statement

Director’s Self Assessment Tax Return

Quarterly Bookkeeping Review and Guidance

Assistance throughout the year with queries

Assistance with any HMRC correspondence

Monthly Payroll for up to 5 Employees

Monthly Management Accounts

Package 3

Limited Company

£250 - 500 per month

Services Include:

Xero Accounting Software

Monthly Bookkeeping Review and oversee Bookkeeping Processes and Timelines.

Monitor Customer Invoice Payments and Supplier Payments

Director’s Payroll

Quarterly VAT Returns

Year End Accounts

Corporation Tax Return

Confirmation Statement

Director’s Self Assessment Tax Return

Monthly Management Reports with Tax Advice

Assistance throughout the year with queries

Assistance with any HMRC correspondence

Package 4

Limited Company with bookkeeping services

£500 - £1,000 per month

All Services as Package 3 plus the following bookkeeping services:

Process Customer Invoices and Monitor Payments Received

Process Supplier Invoices, Supplier Queries and Provide Payment Schedule

Customer Payments Due Report

Supplier’s Invoices Due Report

Reconcile Bank Account and Credit Card Account

Ensure correct treatment of VAT on all invoicing, if applicable

Monitor Accounts Email Inbox, if required

Package 5

Limited Company with Bookkeeping PLUS Management Accountant / Finance Director Services

From £1,000 per month

All Services as Package 4 plus the following Management Accounts:

Month by Month Profit and Loss Report

Monthly Corporation Tax Calculations for Forward Planning

Tax and Dividend Planning

Monthly Budget and Actual Variance Report

Monthly Cash Flow Forecasting Report

Specific / Customised Reports for Director / Board Meetings / Investor Requirements

Company Department Reports

Cost Centre Reports

ONS Surveys

Assistance with Industry Specific HMRC Requirements