CIS (Construction Industry Tax)

CIS (Construction Industry Tax)

£25 per month up to 5 subcontractors

Subcontractors

Whether you’re a plumber, electrician, scaffolder, builder, carpenter plus many other trades operating as a sole trader or a Limited Company and working as a subcontractor, you are likely required to register for CIS.

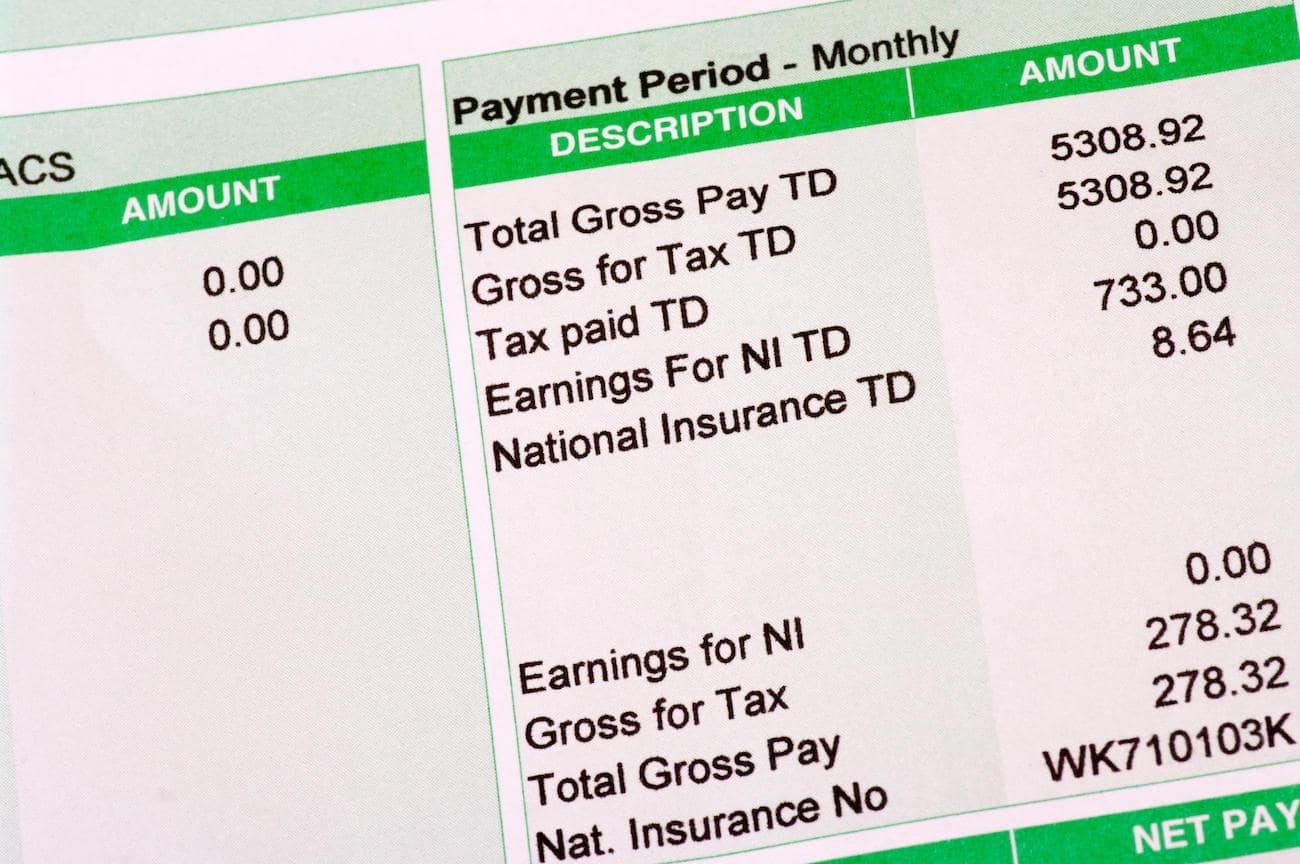

Subcontractors unregistered for CIS are liable to have 30% tax deducted from their paid earnings.

This can be reduced to 20% or even 0% by achieving Gross Status for CIS, if specific conditions are met.

Tax may be able to be reclaimed or offset against your end of year tax bill depending on your personal situation.

Contractors

When sub-contracting work, it is the contractor’s responsibility to ensure they are deducting the correct amount of CIS from their sub contractors, submitting monthly CIS returns to HMRC, paying the correct amount of CIS or offsetting against PAYE liabilities and issuing monthly deduction statements to subbies.

HMRC issue penalties for late filing and payment of CIS.

We can ensure all submissions are completed accurately and on time.

Domestic Reverse Charge VAT

This can be a confusing area of VAT and is linked to the Construction Industry – we can advise you on when to charge, when not to charge and provide an easy to follow guide to ensure your customers and suppliers have the correct VAT treatment applied on their invoices.

Get in touch to how LB Accounts can help. By understanding the core principles for setting up your business and your long term goals, we can help you reach that destination.